It is not advisable, James, to venture unsolicited opinions. You should spare yourself the embarrassing discovery of their exact value to your listener.

Wednesday, August 24, 2005

T-Shirt of the day

Available at Those Shirts I have the "celebrate diversity" one from them.

Tuesday, August 23, 2005

Quote Tag

"If it flys, floats, or f**ks, rent it" - P.J. O'Rourke

"Life, liberty, and property do not exist because men have made laws. On the contrary, it was the fact that life, liberty, and property existed beforehand that caused men to make laws in the first place" - Frederic Bastiat

Now I'm going to tag Eli, Lebowski, Russ, and Jessica Lovejoy.

PS (8/25/05) - I can't believe I forgot these classics:

"F**k that s**t man, Pabst Blue Ribbon!" - Frank (Dennis Hopper), from Blue Velvet

"F**king Chrysler plant, here I come!" - Slapshot

Saturday, August 20, 2005

The prudent bear

James Grant - More on bonds an current accounts.

Another great one is an explanation of the current accounts system titled "The current account for stock jockeys"

Both are great resoucres, and will offer a lot of insight into the world of interest rates, money and international banking.

Friday, August 19, 2005

Looming banking crisis in China

Thursday, August 18, 2005

Bush's immigration nonsense

- Beef up border security to prevent illegals from entering the country.

- Bring in laws that severely punish companies for using illegal aliens as labour.

- Have local law enforcement check the immigration status of all suspects arrested, if they are here illegally - the INS must deport them within 72 hours

- Refom the process of immigration into the country. Clarify the criteria of who qualifies, and have an answer for them promptly - like 90 days. There is no reason for the confusion that is presently the INS where it can take years to determine whether one can immigrate into the U.S. or not.

The sad part is that neither political party has any stomach for this. As Pat Buchanan once said, "The Democats see illegals as potential Democratic voters. The Republicans see illegals as a source of cheap labor."

Wednesday, August 17, 2005

Mortgage interest deductibility

Here are my obsverations:

- The vast majority of income tax filers in the U.S. do not have sufficient mortgage interest to itemize their deductions rather than use the standard deduction. The majority of 1040 filers can not take advantage of this.

- The deductibility of mortgage interest lowers the cost of capital, and inflates housing prices by increasing the amount of financing buyers can obtain given a certain costs.

- Tax measures like this have unintended consequences. When president Reagan brought in tax reform in 1982, one of the stimulus packages was to lower the depreciable lives of property from 40 to 19 years. This created a boom in commercial and residential rental construction - and is one of the prime causes of the 1990's real estate bubble.

- Finally, once you bring in targeted tax cuts, you open up the Pandora's box and every little thing the electorate wants becomes a deduction or what not. This is why the 1040's in the U.S have become increasingly complex.

Monday, August 15, 2005

Detroit - Taxed and regulated to ruin. A cautionary tale.

The second one is a Mackinac research paper on the affects of taxes on economic prosperity of Michigan local governments.

If one wants to see how to drive a city into the dump - raise taxes and put up tons of red tape! That's a good start - you'll see David Miller in Toronto getting the idea!

Saturday, August 13, 2005

The silver lining in high gas prices

But here is the silver lining, albeit long-term, in the short run spike in gasoline prices:

- This is dampening consumer spending. Not enough to cause a recession, mind you, but enough to temper inflationary pressures.

- The spike in prices, coupled with interest rates, is cooling off the housing market. This lessens the possibility of a major correction in the housing market, and it is slowly forcing all those folks who took second, third, and forth mortgages on the house for consumer spending to start seriously thinking about deleveraging. The deleveraging the reduction of speculation in the housing market will lower consumption, reduce inflationary pressures, and strengthen the U.S. dollar.

Thursday, August 11, 2005

Divergence in U.S. and Canadian Fertility Rates

Wednesday, August 10, 2005

Bruce Bartlett on Sarbanes Oxley

Tuesday, August 09, 2005

Gun violence in Toronto - Hang Them All!

ExxonMobil versus Philip Morris - a tale of two stocks

- The profit margins for Exxon (XON/NYSE) should be significantly higher than other S&P 500 stocks.

- The P/E ratio should be significantly higher on the stock, reflecting the above average profit potential of the company.

- The share performance, over the long run, be superior to all other stocks on the S&P 500.

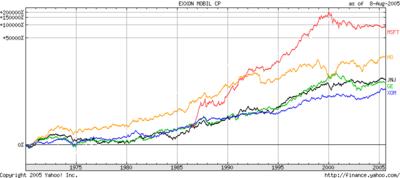

Let's see how they line up. For comparison, let's use Johnson & Johnson (JNJ/NYSE), WalMart (WMT/NYSE), Microsoft (MSFT/NASDAQ), and Philip Morris (MO/NYSE) as a sample of comparable sized companies in different sectors.

First, let's take a look at the long term charts for these stocks (see above). XOM is not even the top performer over the long-term vis other sectors of the economy. Second, the profit margin for XOM as of today is 9.94%. WMT is 3.63%, JNJ is 18.36%, MO is 14.55%, and GE is 11.29%. These numbers suggest, along with the chart above, the XOM's profitability is within the expectations of the largest S&P 500 companies.

In summary, the profitability of integrated oil companies are in line with the market as a whole, and is reflected in the relative performance of oil companies versus other sectors.

When I have the time, I'll make a more detailed analysis of the sector and the claim of 'obscene' profits.

Oil Prices, Interst Rates, Inflation and What Not

Many of you probably have seen this chart, showing the differences in prices on an absolute and real basis on a few items from 1980 versus today. The other key statistic that is missing is that in 1980, long term interest rates (i.e. 30-year Treasury) were in the 15% range, while today long term rates are 4.5%. That is a key thing to consider as well. A family with a mortgage generally had a rougher go of it in 1980 than 2004 in terms of prices and costs of housing. Another factor is the general improvement of fuel economy of cars during this period, which also is a mitagating factor.

Friday, August 05, 2005

Damian Brooks on Public Transit

- The government is running it, so it will be bloated, inefficient, and unreliable.

- It is financially questionable to throw a lot of government money into an endeavour that cannot recoup all its costs from fares. If it is like VIA Rail, the TTC and GO, then the question that arises from this is: (a) is this the optimal use of public funds, and (b) can't the private sector do a better job?

I guess my main concern is preserving value for the taxpayers, with my secondary concern being limiting the activities of government. As it stands, I'd rather see the money invested in improving the road system and providing tax breaks (in terms of lower property taxes especially) on railroads as an incentive for them to get into the commuter business.

Finally - who would have ever thought of a bunch of right-wing shills discussing public transit!?

Where do you you stand

Thursday, August 04, 2005

Tories, Tax Breaks, and Public Transit

There are just two problems with mass transit. Nobody uses it, and it costs like hell. Only 4% of Americans take public transportation to work. Even in cities they don't do it. Less than 25% of commuters in the New York metropolitan area use public transportation. Elsewhere it's far less--9.5% in San Francisco-Oakland-San Jose, 1.8% in Dallas-Fort Worth. As for total travel in urban parts of America--all the comings and goings for work, school, shopping, etc.--1.7 % of those trips are made on mass transit.Then there is the cost, which is--obviously--$52 billion. Less obviously, there's all the money spent locally keeping local mass transit systems operating. The Heritage Foundation says, "There isn't a single light rail transit system in America in

which fares paid by the passengers cover the cost of their own rides." Heritage cites the Minneapolis "Hiawatha" light rail line, soon to be completed with $107 million from the transportation bill. Heritage estimates that the total expense for each ride on the Hiawatha will be $19. Commuting to work will cost $8,550 a year. If the commuter is earning minimum wage, this leaves about $1,000 a year for food, shelter and clothing. Or, if the city picks up the tab, it could have leased a BMW X-5 SUV for the commuter at about the same price.

Tuesday, August 02, 2005

Now I remember why I love Tiger Stadium

From the Ruins of Detroit Tour, the dank of Tiger Stadium I miss oh so much. You can't replicate this stuff. This is what symbolizes Detroit in all its glory.